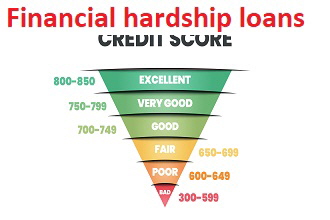

Loans for people with poor to fair credit scores.

Find lenders that offer loans for borrowers with poor or low credit scores or that even lack credit to begin with. Banks, credit unions, fintech companies, online lenders, and non-profits can all offer emergency funds. There are small dollar hardship loans for applicants that have a low FICO scores or that are trying to build/improve their credit. Find loans for people with poor credit scores listed below.

The organizations that will provide a loan to an applicant with poor to fair credit scores (under 670) are wide ranging, including from online websites or local lenders. Some people will be able to get the money within a day or two, while charities or non-profits often take more time to provide funds. However, with any loan (especially if you have poor credit scores) also be sure to consider fees, annual APR rates and read the terms and conditions closely.

Government affiliated loans provided to people with low credit scores

|

Families with a low-income and/or bad credit looking to buy a home can use government loan programs, such as from FHA or other agencies. The government will help single people as well as families, including applicants with under a 670 FICO credit score. This type of loan product, while focused on helping people pay for a house, will generally be more straightforward as the money is provided directly by a government agency. Find government loans for buying a home.

Community Action Agencies often provide loans or hardship funds, with a focus on low-income borrowers, or applicants with a low FICO score. Many of these agencies are also involved in the government grant process. As part of this, personal loans or other funds may be provided for paying bills, transportation costs, job training costs and more. Locate a community action near you for hardship funds.

Loans from the government will help small business owners or entrepreneurs. The money can be provided by a local county government, the state or federal agency as these programs “come and go” throughout the year. Many banks, credit unions and non-profits also offer loans to businesses who have no or bad credit with the money intended to help pay for business expenses. They also give money to women, disabled, and minority business owner, even if their income is low or credit is poor. Find more details on microloans for female and minority owned businesses.

Loans from credit unions for people with bad credit

|

Many non-profit credit unions offer personal hardship loan programs that can help those borrowers with limited or no credit scores. The credit unions will issue a loan to qualified applicants as well as offer other ongoing support, such as budgeting help, financial literacy services and more. The online and in person lenders are part of the National Credit Union Administration (NCUA) which limits the applicant’s risk. NCUA is involved in coordinating services as well as assistance programs nationwide, and all products provided meet FDIC as well as other federal government guidelines. Find a location here at loans from credit unions.

- One product available locally is known as PALS, or Credit Union Payday Alternative Loans and Savings. It combines financial literacy and gives families the ability to borrow money at a low interest rate. The program is for people that lack credit or have poor scores from one of the rating bureaus. More on loans from PALS.

Loans for people with a low credit score from a charity or non-profit

|

Loans from non-profits and charities, including community action, may be an option for a struggling person. Many do not have a credit check for applicants. It is often possible for borrowers with bad credit, no money or an under 670 FICO score to get a low interest loan from a non-profit or charity organization (see lenders below). Most of the agencies will require the borrower to undergo extensive financial counseling. As one of the key goals is to improve the individual’s overall financial literacy and learn more on community action programs that may be near you.

Way to Work loans are for employment reasons. The non-profit offers low income borrowers with little or poor credit access to a loan for transportation reasons. The program can even provide loans to people with “poor” credit scores as low as the 500 range on the FICO scale. The funds can help pay for a used car or repairs so the borrower can either get to work, or keep an existing job. Find details on Ways to Work loan.

Interest free loan programs are often for borrowers with poor to fair credit histories. These emergency funds are available from a small subset of non-profit organizations. Generally the guaranteed personal loans with a zero% interest rate is issued only for paying certain bills or covering some needs in a hardship. But they can be an option for borrowers with poor-fair credit and find more information on free loans.

Religious organizations, including churches, can sometimes provide a hardship loan to a family that has fair to poor credit scores or even unemployed person. These programs often assist the vulnerable, including immigrants, refugees, Spanish speakers, and the working poor that are starting a new job. The funds will come with a competitive interest rate, and read more about loans from churches.

Hardship loans for disabled adults are offered, even if they have a bad FICO credit score. The money is usually guaranteed and has online applications. The FDIC also works with social security administration, states as well as local non-profits to offer no credit loans to the disabled. These individuals, due to the fact they often live on a fixed, limited income, often are not in the mainstream lending industry. But people with a disability can benefit too and learn how to find and apply for disability loans. Hardship loans for disabled adults are offered, even if they have a bad FICO credit score. The money is usually guaranteed and has online applications. The FDIC also works with social security administration, states as well as local non-profits to offer no credit loans to the disabled. These individuals, due to the fact they often live on a fixed, limited income, often are not in the mainstream lending industry. But people with a disability can benefit too and learn how to find and apply for disability loans.

The elderly, retirees, and seniors with bad credit can also get a loan. There are Aging on Aging centers, non-profits that offer funds while the applicant is waiting on their social security to start, government programs and other options. The senior citizen who is borrowing money can have bad credit and/or a low fixed income and still get a hardship loan. Find more on hardship loans for senior citizens and the elderly.

Credit score is key when applying. If someone takes out a salary advance loan from a payday lender, the fees and interest they will pay back over time does not benefit them. This is why a credit union, FDIC approved bank or non-profit near you may be a better place for a hardship loan. There are even credit builder loans for borrowers with bad credit.

Loans from a business or online lender if you have a bad credit score

|

Online loan marketplaces, or aggregators, make it easier to find a loan that is available for applicants with poor credit scores. The funds are offered to households of all backgrounds, income levels and FICO scores. While funds are available from the lenders on an aggregator site, they will often have a higher APR rate or fees. Lenders also help serve individuals who do not have a checking or savings account as well as people facing a financial emergency and find details on loan aggregator sites for poor credit score borrowers.

Oportun is a lender focused on low-income / credit score applicants. There are some lower cost options for consumers to consider. For example, one socially responsible lender is Oportun. While they do offer short term loans, the interest rates are much lower and the financing is also combined with free credit counseling and other educational services for borrowers. More on Oportun low interest rate loans.

OppLoans (while sounding similar to above but a different lender) is another option. The lender partners with community lender, such as local banks and credit unions, to issue loans. They also offer a free educational online service known as “OppU” which helps people build knowledge over time around budgeting, debt reduction and more. Learn more on OppLoans for borrowers with a poor credit score.

Car or auto title loans are an option for people that own a vehicle. This product will allow people to borrow money against the value of their automobile, truck, or even motorcycle. It is offered by both payday lending companies and other non-traditional banks that may be near you or that operate online. The borrower’s car is in effect used for collateral for the loan. It can provide quick cash, but there are many risks when going down this path. Learn more on car title loans.

Pawn shop loans that may be near you can be used when the person has collateral to borrow against. The broker will appraise the item being sold and then provide the customer cash for the product. Any money paid out will be in the form of a short term loan, and the interest rate tends to be more affordable that many other products. This form of financing is regulated by the state and federal governments. Continue with pawn shop loans.

Check cashing store loans are a way for people to get their income in advance. A number of companies will help people, normally those with bad credit or a low-income, get easy, quick access to their funds. Sometimes also called “payroll advance”, “check cashing”, or “salary advance”, the emergency short term loans from these organizations provide a fast way to access emergency money to help with paying bills. Many states regulate them as well as the entire industry. Get details on funds issued by check cashing stores.

Buy Now Pay Later companies, such as Paypal and Venmo, offer installment loan products for borrowers with no or a low credit rating or even bank account. They also allow the borrower to get the item they are shopping for today but to pay back the funds in a short window of time, such as a few weeks. It is similar to “layaway” in some aspects. But BNPL is a great way for people with limited or no credit, to get a short term emergency hardship loan. Learn more on Buy Now Pay Later no credit loans.

Online Peer to Peer lending companies provide bad credit loans. Borrowers need to complete an online application and then other people (“peers”) from around the world make offers. The amount of money tends to be limited, but these are emergency, almost guaranteed loans for people with no or bad credit. Get details on peer to peer instant loans for bad credit.

It is possible to get a hardship loan without a bank account as well. Many people that have had past credit issues are “unbanked” for a wide range or reasons. This means they have no bank or checking account. No matter the reason, and regardless of their credit scores, they can also get a loan. Locate no bank account loans.

Loans from apps for people with under 700 FICO scores are an option. While anyone can apply, several online lenders focus on providing cash to gig workers or people with variable income. The smartphone apps are for Apple iOS and well as Samsung. Locate loans for gig workers with bad credit.

Bad credit medical loans and financing alternatives are available. Many lenders focus on lending money to patients so they can pay for health care, surgery (including elective or cosmetic), dental care and more. There is often instant approval for a medical loan with applications online or an app. Find medical loans.

Some online lenders provide bad credit hardship loans in an emergency or to families facing a financial hardship. They will immediately transfer money to a qualified low income borrower’s bank account within a matter of hours or a day. There are charities, non-profits as well as private companies that can provide this hardship loan service, including to applicants with no credit or bad credit scores. Find more details on emergency loans.

As noted, a key objective of loans being issued by any non-profit or government agency is to stop individuals with no access to credit from turning to payday companies. Case managers at a non-profit realize when someone goes down that path it can often lead to a vicious cycle, and then maybe bankruptcy. So these loans and the advice given with them can help borrowers find an alternative to using payday lenders.

- Borrowers that have a poor credit score and that use payday lenders are not able to build their credit scores using those funds. On the other hand, non-profit and bank loans due allow people with bad credit to improve their credit ratings. In today’s day and age, a failure to build, or at least improve, a credit score limits low-income individuals' ability to advance economically. It can prevent them from even getting a job in certain cases. Find other ways to improve your credit rating.

- A major challenge is that many payday lenders may make it difficult to stop a withdrawal from your bank account. Borrowers have been charged improper overdraft fees and other charges on their accounts. The federal government and the Electronic Fund Transfer Act can protect consumers from these fees and recurring withdrawals. It also helps regulate the industry and the transfer of funds. Find how to stop withdrawals from payday lenders.

Online lenders offer unsecured loans for people with low credit scores or an income. These also come with higher interest rates and should be more of a last resort and also reviewed closely. The payment terms will usually be over the course of several months or a few years. Continue with unsecured personal loans.

Conclusion - Loans for applicants with a low - fair credit score exist

As noted above, there are many resources out there. Banks partner with FDIC or federal government to offer people with poor credit or the unbanked a loan. There may also be charities near you that may offer small dollar loans to low income families with poor credit, financing products from credit unions, private companies, BNPL installment loans and other sources of funds. While it is often not the best option to take out a loan if the borrowers credit score is low (as the fees and rates are higher) the options above can be explored.

Related Content From Needhelppayingbills.com

|